Image courtesy Maryland Department of Commerce

Talbot Economic Development and Tourism staff announced the expansion of the Easton Enterprise Zone. This incentive allows more businesses in Easton to be eligible for real property and income tax credits. The Enterprise Zone is a Maryland Department of Commerce Incentive that is administered locally and allows businesses operating within the zone to be eligible for real property and tax credits.

Working in close cooperation with the Easton Economic Development Corporation–the administrators of the Easton Enterprise Zone–the two agencies received approval from their respective councils to draft legislation to expand the current zone.

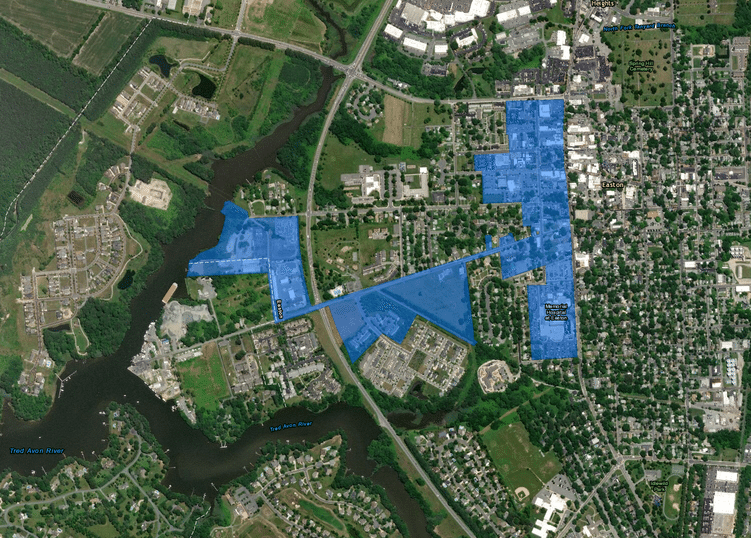

The original Easton Enterprise zone, the first created in Talbot County, covered 90 acres and was concentrated in downtown Easton and along Port Street (seen in the image above). This zone also includes Shore Medical Center, the flagship hospital Shore Regional Health operates that could soon be relocated.

The newly expanded Enterprise Zone will now include properties that have recently been annexed by the Town of Easton on Easton Point, and Talbot Commerce Park and Mistletoe Hall Commerce-Business Park.

During a presentation to the Talbot County Council regarding the expansion of the Enterprise Zone, Cassandra Vanhooser, director of Talbot County Economic Development and Tourism, said “It is a tool in our toolbox for recruiting businesses to come and put their enterprises here in Easton and Talbot County.”

85 acres on Tilghman Island are also designated an Enterprise Zone.

Businesses located in Maryland’s 37 enterprise zones have received approximately $45 million in property tax credits in FY 2018 based on more than $3 billion in capital investments made in FY 2017. Over the past five years, businesses in Maryland’s enterprise zones have made a total of $13.5 billion in capital investments.

Any business that makes a $25,000 investment and/or adds at least two additional employees is eligible to apply for the enterprise zone tax credits if the business is within the boundaries of the zone. Businesses are encouraged to contact the Easton Economic Development Corporation for additional information about the Easton Enterprise Zone. For questions regarding the Tilghman Island Enterprise Zone, businesses are encouraged to contact the Talbot County Department of Economic Development and Tourism.

To see an interactive map of the State’s enterprise zones, click here.